As of November 1, 2021, the most recent round of Australian legislation regarding the governance of corporate entities comes into effect.

Why the changes?

In order to make the tracking and regulation of directorships easier and more accountable, the Australian Securities and Investments Commission (ASIC) has implemented a requirement for all company directors to verify their identity with the newly-created Australian Business Registry Service (“ABRS”) and obtain a unique director identification number (director ID).

This change is expected to assist in the determent of “phoenixing,” a practice whereby a company deliberately avoids paying liabilities by shutting down an indebted company whilst transferring assets to another company.

The director ID will be a unique identifier that a director will keep forever, enabling regulators to better track directors of failed companies who use fictitious identities.

Who is affected by this?

Any individuals acting as directors, or alternate directors, of Australian companies will need a director ID.

Australian companies include:

- company

- Aboriginal and Torres Strait Islander corporation

- corporate trustee, for example, of a self-managed super fund

- charity or not-for-profit organisation that is a company

- registered Australian body, for example, an incorporated association that is registered with the Australian Securities and Investments Commission (ASIC) and trades outside the state or territory in which it is incorporated

- foreign company registered with ASIC and carrying on business in Australia (regardless of where you live).

As at time of writing, the new regime does not include:

- company secretaries

- an external administrator of a company

- those running a business as a sole trader or partnership

- individuals with ‘director’ in their job title that have not been appointed as a director under the Corporations Act

- a director of a registered charity with an organisation type that is not registered with ASIC to operate throughout Australia

- an officer of an unincorporated association, co-op or incorporated association established under state or territory legislation, unless the organisation is also a registered Australian body.

What do I need to do?

Basically, you need to apply for a director ID number and send it through to the Perks Corporate Registry Team at your earliest convenience, prior to 14 December 2022. The sooner you send it in the better so that you are not rushing to apply and submit just prior to the deadline.

You can reach the Perks Corporate Registry Team at corporateregistry@perks.com.au

You should also notify all directors of the companies you are currently a director with, of the new requirements to obtain a director ID.

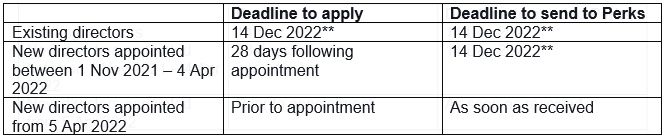

When do I need my director ID number by?

** Originally 30 Nov 2022, now extended to 14 Dec 2022

How do I apply for a director ID number?

If you fit into the description of a director above, you need to apply for your director ID number.

Please note that your Perks Adviser is not able to process this application for you, as your myGovID is directly tied to your specific individual identification. We are happy to help with any questions that you may have or walk you through the process. You can contact our Corporate Registry team at 8273 9300 or corporateregistry@perks.com.au

There are three ways you can apply for your director ID number:

1. Digital application

The ATO are actively encouraging directors to use this option. In order to lodge a digital application you will need to have or set up a myGovID account.

Once you have your verified myGovID, you can login and apply for your director ID on the ABRS website.

More details on the other documents you will need to lodge as part of your online application can be found here.

2. Phone application

To apply for your director ID over the phone, you will need to phone 13 62 50 and verbally answer questions regarding proof of identity documents.

More details can be found here on what to pre-prepare.

3. Paper application

To apply for your director ID via paper application, you will need to download the ABRS PDF form.

You will need to provide certified proof of identity documents. More details can be found here on what to pre-prepare.

How do I notify Perks of my director ID number?

Please email the following details to our Corporate Registry Team at corporateregistry@perks.com.au

1. Full Name

2. Director ID number

If you have any questions, please don’t hesitate to send them through to our Corporate Registry Team or contact your Perks Adviser.