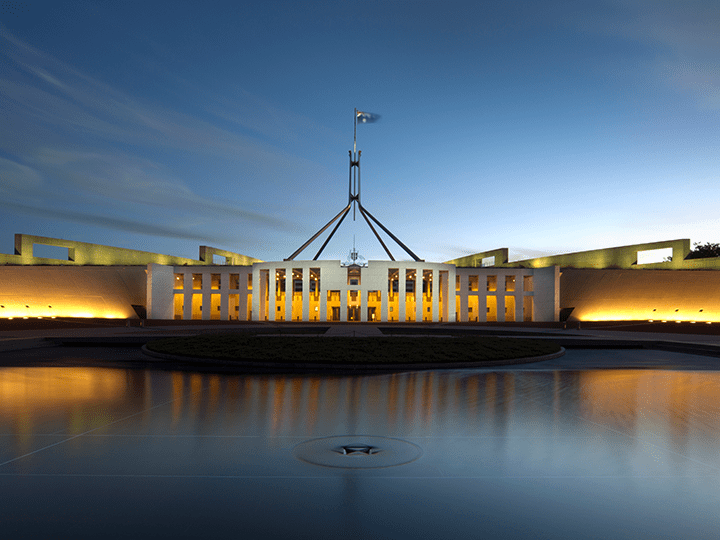

2023-24 Federal Budget Summary

Posted on 11/5/2023

Tax

Overview:

The 2023-24 Federal Budget was delivered by Treasurer Jim Chalmers this week. As more detail is released over the coming weeks on the announced policy changes, we will provide a more in-depth view and analysis. In the meantime, here is a recap of the key budget announcements that may impact you.

Please note, the below measures have not been legislated and advice should be sought before relying on the contents of this article.

For Businesses

Impacts for Small Business

Instant Asset Write-Off

With the conclusion of the Full Expensing of Depreciating Assets Measure as and from 30 June 2023, it was expected that the pre-COVID depreciation rules would return. These rules being that only Small Business Entities can fully deduct the cost of a depreciating asset where the relevant asset’s cost is less than $1,000. However, the Government has announced that:

- For the 2023/24 income year, Small Business Entities can fully deduct a depreciating asset where the relevant asset’s cost is less than $20,000.

- A Small Business Entity is an entity carrying on a business with an aggregated turnover of less than $10M.

- The relevant asset must be first used or installed ready for use between 1 July 2023 and 30 June 2024.

- The measure applies on an asset-by-asset basis, meaning multiple assets can be fully deducted.

This measure allows small businesses to invest in necessary plant and equipment and immediately claim the cost as a tax deduction.

Accelerated Depreciation for Energy Efficient Equipment

In addition to the Instant Asset Write-Off, Small and Medium businesses switching to energy-efficient equipment or facilities can obtain additional (accelerated) depreciation deductions of 20%. The key features of this measure are:

- The additional (accelerated) depreciation deduction is 20% of the asset’s cost and applies for the 2023/24 income year.

- The total accelerated deduction available is capped at $20,000, effectively meaning that it can only be applied to an asset or total assets costing $100,000.

- The relevant asset must be first used or installed ready for use between 1 July 2023 and 30 June 2024.

- A Small and Medium Entity is an entity carrying on a business with an aggregated turnover of less than $50M.

- Eligible assets include those upgraded to more efficient electrical goods (e.g. energy efficient fridges), those that support electrification (e.g. heat pumps and electrical heating/cooling systems) and energy demand management assets (e.g. batteries and thermal energy storage).

- Excluded assets are electric vehicles, renewable energy generation assets, capital works expenditure and assets that are not connected to the electricity grid (i.e. fossil fuelled assets).

Other Measures

- A one-time payment of $650 to help small businesses with power bills.

- Small businesses can take advantage of the $23.4M “Cyber Wardens” program to enhance cyber skills.

- The GDP adjustment factor for PAYG and GST instalments will be halved for small businesses. The adjustment rate will drop from 12% to 6% for eligible businesses with up to $10M annual turnover for GST instalments and $50M annual turnover for PAYG instalments.

Superannuation Obligations for Employers

- Starting from July 1, 2026, employers must pay superannuation at the same time they pay salary and wages to employees.

- This change aims to give employees better visibility and control over their entitlements and helps the Australian Taxation Office (ATO) in recovering unpaid superannuation.

- The ATO will receive $40.2M to improve their ability to match data and take action against cases of underpaid super.

Fringe Benefits Tax Exemption Changes for Plug-In Hybrid Electric Cars

- The Government will remove plug-in hybrid electric cars from the fringe benefits tax exemption for eligible electric cars.

- This change will come into effect on April 1, 2025.

- Any arrangements involving plug-in hybrid electric cars entered into between July 1, 2022, and March 31, 2025, will still be eligible for the Electric Car Discount.

For Households and Individuals

Superannuation

Superannuation Balances over $3 Million

- From July 1, 2025, individuals with superannuation balances over $3M will face a higher tax rate of 30% on their earnings, up from the current rate of 15%.

- Importantly, it is only the proportion of earnings deemed to have been derived from the assets exceeding the $3M threshold that will be subject to the 30% tax rate.

- Approximately 80,000 people, which is about 0.5% of superannuation members, are expected to be impacted by this change.

- The number of affected individuals may increase over time as the $3M cap is not adjusted for inflation.

- It is important to note that the specifics of this measure are unknown and information in prior publications by the Government have been hotly debated in the superannuation and taxation industries.

Super Fund Non-Arm’s Length Expenditure

Changes will be made to the non-arm’s length income (NALI) provisions that affect expenditure incurred by superannuation funds. Specifically:

- The income of self-managed superannuation funds and small APRA regulated funds that is taxable as NALI will be limited to twice the level of the relevant general non-arm’s length expense.

- Assessable (non-concessional) Contributions will be excluded from fund income taxable as NALI.

- Large APRA regulated funds will be exempted from the NALI provisions for both general and specific expenses of the fund.

- Expenditure that occurred before the 2018-19 income year will be exempted from these provisions.

Medicare Levy

- Starting from July 1, 2023, the Government has made changes to the Medicare levy thresholds for low-income earners, which include singles, families, seniors, and pensioners.

- The income thresholds for each category will increase, providing relief for low-income earners.

- The family income thresholds for dependent children or students will see the largest increase.

- From July 1, 2024, certain taxpayers will be exempt from paying the Medicare levy on eligible lump sum payments received in arrears, such as compensation for underpaid wages.