UPDATED: Stimulus Package for Individuals and Households

Posted on 24/3/2020

Overview:

As you may be aware, the Federal Government has now announced a second round of stimulus/ survival measures on top of those previously announced on 12 March. We’ve summarised the proposed changes targeting individuals/ households below that may aid in supporting you and your family. The total Federal Government package now represents $189B in economic initiatives and aims to prevent a significant slowdown in economic activity.

Individuals / Households

Lower-income Australians, pensioners, other social security and veteran income support recipients and eligible concession card holders will be eligible for cash payments as follows.

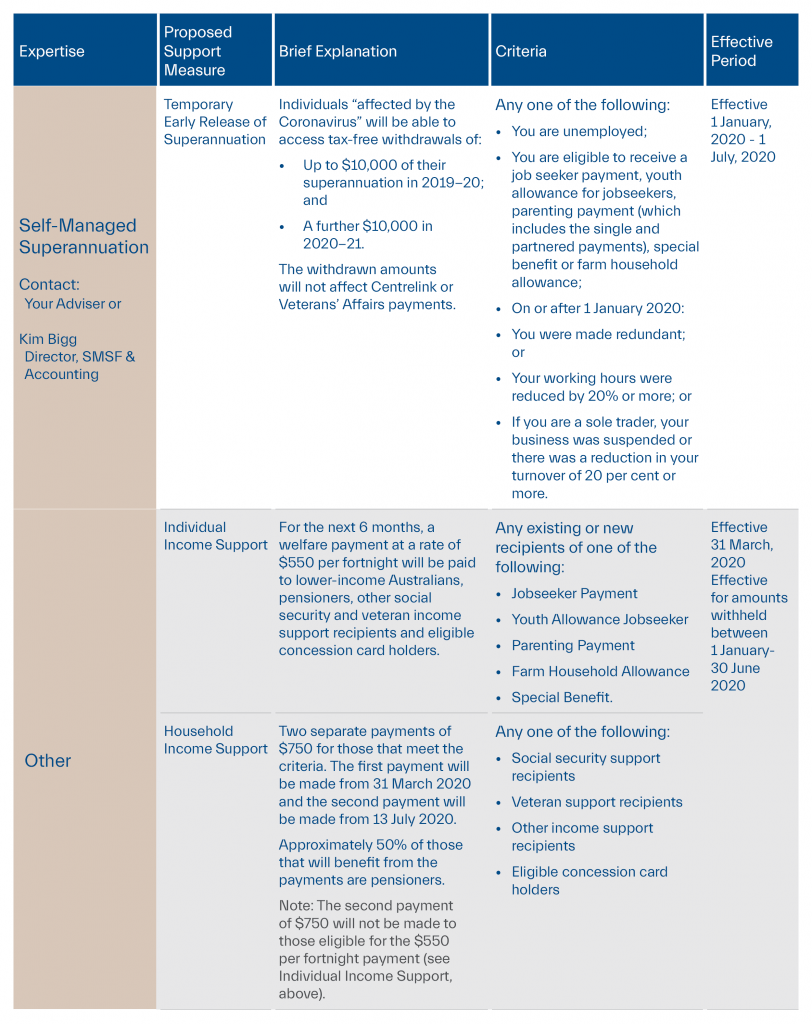

Individual Income Support

For the next 6 months, a welfare payment at a rate of $550 per fortnight will be paid to both existing and new recipients of Jobseeker Payment, Youth Allowance Jobseeker, Parenting Payment, Farm Household Allowance and Special Benefit.

Household Income Support

Two separate payments of $750 will be received by social security, veteran and other income support recipients and eligible concession card holders. The first payment will be made from 31 March 2020 and the second payment will be made from 13 July 2020.

Approximately 50% of those that will benefit from the payments are pensioners. The second payment will not be made to those eligible for the $550 per fortnight payment (above).

Temporary Early Release of Superannuation

Individuals “affected by the Coronavirus” will be able to access up to $10,000 of their superannuation in 2019-20 and a further $10,000 in 2020-21 – tax free. The withdrawn amounts will not affect Centrelink or Veterans’ Affairs payments.

To apply for early release you must satisfy one or more of the following requirements:

- You are unemployed;

- You are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance;

On or after 1 January 2020:

- You were made redundant; or

- Your working hours were reduced by 20% or more; or

- If you are a sole trader, your business was suspended or there was a reduction in your turnover of 20 per cent or more.

From mid-April eligible individuals will be able to apply to the ATO online through myGov to access up to $10,000 of their superannuation before 1 July 2020. They will also be able to access up to a further $10,000 from 1 July 2020 for approximately three months (exact timing will depend on the passage of the relevant legislation).

After the ATO has processed the application, they will issue the member with a determination. The ATO will also provide a copy of the determination to the member’s superannuation fund, which will advise them to release the superannuation payment. The member’s fund will then make the payment to the member, without the member needing to apply to them directly.

Separate arrangements will apply for members of SMSFs. The ATO will publish guidance shortly for SMSFs.

Example:

Ed works in a popular bar in Melbourne. As a result of the Coronavirus, Ed has had his work hours reduced from 40 hours on average in the second half of 2019 to 20 hours per week on average in May 2020. As a result, Ed determines that his hours over the last month have reduced by more than 20 per cent compared to the average of his hours over the last six months of 2019. Ed decides to apply for the early release of $8,000 of his superannuation in May 2020 to help pay his rent and other living expenses. Ed self-certifies that he is eligible for early release on myGov. He could have applied for up to $10,000, but chose not to. Ed cannot seek any further early release of superannuation in 2019-20 on the grounds that he has been affected by the adverse economic effects of the Coronavirus.

However, Ed finds after 1 July 2020 that his hours continue to be reduced by more than 20 per cent compared to the average of his hours in the last six months of 2019. Ed decides to make a second application and self-certifies through myGov that he is eligible for early release. He is able to apply again for a release of up to $10,000 of his superannuation. Ed submits a second application for the full amount of $10,000 this time. For each application, the ATO approves Ed’s early release and notifies both him and his superannuation fund. Ed has received a total of $18,000 of his superannuation in two separate payments. He will not be taxed on this amount and is free to spend this money on anything he chooses, or save it for future expenses. He is also free to recontribute any unused amounts to his superannuation in the future (within his contribution caps).

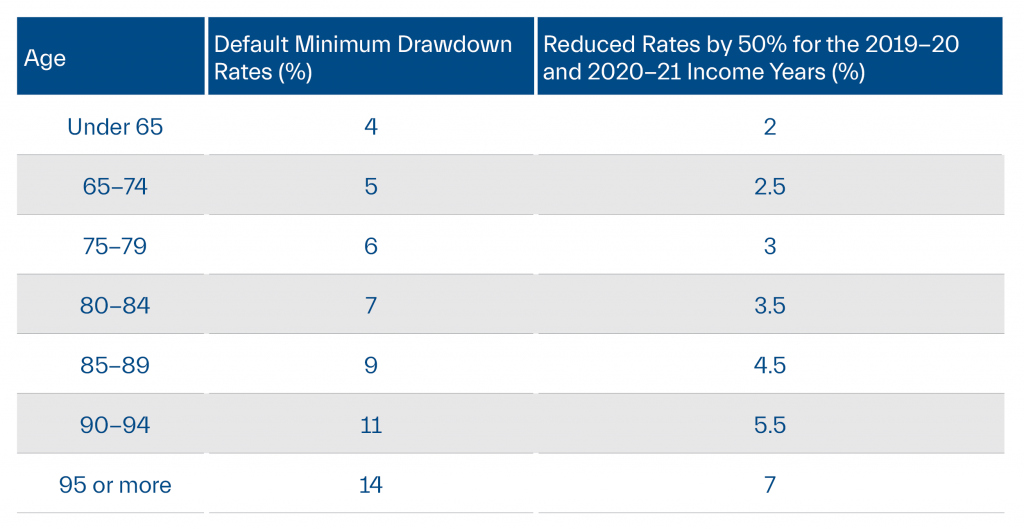

Temporarily Reducing Superannuation Minimum Drawdown Rates

Superannuation minimum drawdown requirements for account-based pensions and similar products will be reduced by 50% for 2019-20 and 2020-21. This measure will reduce the need for SMSF trustees to sell investment assets to fund minimum drawdown requirements. The rate reductions are as follows:

Reducing Social Security Deeming Rates

A 0.5% reduction in both the upper and lower social security deeming rates was previously implemented on 12 March 2020. The deeming rates will again be reduced by another 0.25%.

From 1 May 2020, the upper deeming rate will be 2.25% and the lower deeming rate will be 0.25%. The deeming rate change will benefit around 900,000 income support recipients, including around 565,000 Age Pensioners who will, on average, receive around $105 more of the Age Pension in the first full year the reduced rates apply.

Implementation and Timing

A package of Bills is being introduced into Parliament on 23 March 2020 for urgent consideration. Subject to passage of the Bills through Parliament, the Government will then move to immediately make, and register, supporting instruments.

Looking for the latest on the proposed Government Stimulus Package for Businesses? Click Here

Related insights.

Show Me The Perks Podcast | Succession Planning for Business Owners with Vince Tripodi

8/4/2025

In this episode of Show Me The Perks, host Kim Bigg welcomes Perks’ very own Vince Tripodi,...

Read more.

Perks Private Wealth Engages Frontier Advisors in First-Ever Wealth Advisory Collaboration

18/9/2023

Private Wealth

Perks Private Wealth has strengthened its investment capabilities by securing the expertise & resources of Australia’s leading...

Read more.

Client Story: T.R. Edwards & Co.

17/7/2023

Agribusiness

Fifth generation Port Broughton farming family has set clear goals to ensure the business' continuing success. Read...

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.