5 Sources of Income

Posted on 15/5/2020

Private Wealth

Updated May 2020 | Original article published by Simon Wotherspoon Oct 2015

Overview:

Many people think of investment income as just the cash flow we get from bank interest, bonds, share dividends and property rents, some of which comes via a superannuation pension. But a more complete view also considers how growing the value of your investments could add to your wealth potential.

Many people think of investment income as just the cash flow we get from bank interest, bonds, share dividends and property rents, some of which comes via a superannuation pension. But a more complete view also considers how growing the value of your investments could add to your spending potential. This “total return” approach generates income from both income and growth to optimise spending from your portfolio across all market cycles, aligning both cheap and expensive investments to your goals.

Portfolio income can come from multiple sources:

- interest/bond coupons;

- stock dividends; and,

- financial strategies, including derivatives and capital growth.

Each offers some cash flow and some also offer potential capital gain with some risk from liquidity and volatile prices.

In a low-yield environment, many investors rely too heavily on cash flows and to pursue this often venture further into riskier areas than they’d normally consider.

An obvious example is over exposure to bank stocks, which have been excellent investments for over a century. Although bank stocks provide a foundation for most portfolios, bank stocks do involve more risk at certain stages of the economic cycle than many realise. For example, being less exposed to bank shares during the 2020 COVID-19 crisis would have helped many investors preserve some capital. Simply put, a more diversified approach can help mitigate some of these risks.

In focusing on your wealth management goals, investment income is obviously critical, but you might fund your goals from wider sources of income. A typical long-term portfolio might produce about half its return as income and the other half as capital growth, though in times of duress the capital growth component wanes.

In a low-interest rate climate, some sources of income have become quite expensive and may prove disappointing against your spending needs. But by navigating the tax environment efficiently, and sustainably drawing income from wider sources, you might still be able to meet your goals whilst balancing risk against reward more prudently.

Interest and Bond Coupons

These days, low-risk bond yields aren’t enough to meet most income needs. When investing in bonds, the income typically comes as coupon payments – contractually guaranteed interest payments at predictable intervals. There are many kinds of bond income available, so you must strike a balance between reaching for higher income (yield) and limiting risk.

Retirees pay a high price when the world stimulates its way out of a GFC (Great Recession), as seen in 2007/8 and again in 2020.

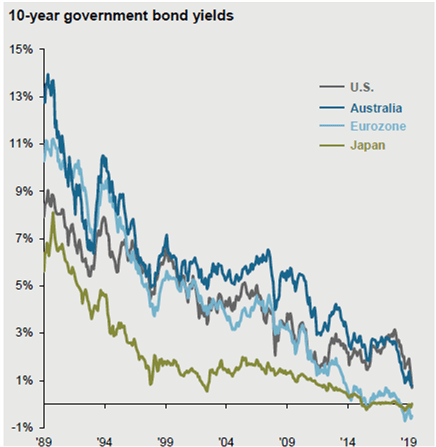

In the example of early 2020, this period came after a 30-year bull market, which saw some of the lowest global interest rates ever. Following this, bonds became quite highly priced and soon did not generate enough to meet income needs.

To illustrate this point, ten years ago the average income from $100,000 that was invested in a 10-year Australian Government Bond (10yrs) was $5,600 p.a.

5 years ago it was less than half at $2,600 p.a.

As at the end of 2019, due to aggressive monetary policy, bond yields fell even further.

Source: JP Morgan

Property Rental Yields & Infrastructure Income

These are interest rate sensitive sectors where rental income from property and infrastructure is linked to the risk-free (cash) rate. In fact, all assets are priced against this, and the more risk they involve, the more their income yield should exceed the risk-free rate to compensate for that risk.

As interest rates come down, the price of property and infrastructure assets rises. If the rent they generate has not risen, much then their income yields will also come down when expressed as a percentage of the now higher capital value.

The reverse can also be expected, unless rents rise too.

A rental increase might occur if we imagine interest rates are rising because the economic environment is improving. In the case of 2020, the global COVID-19 pandemic did impact some share prices in this sector. However, the aftermath of such shifts more often favour those with strong balance sheets, good management and low debt.

Keep in mind that our discussion in this article is focused on listed property and infrastructure due to the attraction of their market liquidity.

Investing in residential property is a slightly different matter. As of 2020, housing prices have risen above long-term trends for many years now; this being said, it might be unwise to expect that this would continue without some market adjustment.

Dividends

Share dividends offer immediate income. In times of crisis however, there is often a growing list of companies that pause or cut dividends because of the financial havoc wrought by the crisis.

In the case of 2020’s COVID-19, this is exactly what happened resulting in the economic shutdown that ensued. It’s worth noting that shutdowns of this nature are most often temporary and market consensus is that most dividends will bounce back.

In the case of COVID-19, the general market consensus is a predicted bounce back in 2021 (based on assumptions that the virus is largely contained, and only minimal restrictions remain in place) with the potential to grow in future years. Of course, it is worth noting that financial crises often don’t repeat but can share a similar cadence; the time to market recovery can vary based on the specific nature of the crisis at hand.

Dividend-paying securities, or funds that invest in them, provide an important source of income in a diversified portfolio. Historically, dividends are remarkably steady and regular – usually paid half yearly by companies or fund managers to shareholders.

Stocks (shares) paying dividends are typically a reliable source of income but they have higher risk of capital losses than cash and bonds. So, it’s wise not to chase yield indiscriminately.

The 10 highest yielding stocks on the ASX 200 (the 200 largest companies in Australia) are shown in the table below (as at April 2020). But their share price performance on average over the last year has been underwhelming, as shown in the far right column:

Capital Growth:

Capital growth in your portfolio can offset the eroding effect of inflation. But any capital gains that exceed the overall inflationary effect can be drawn off to augment your portfolio income. Of course, you must first generate those gains by making thoughtful investment selections. Whilst having strong growth assets in your portfolio can generate growth, it is prudent not to allow them to become a dangerously large part of your portfolio, lest they boil over. In fact, by selectively trimming profitable positions along the way, you can help boost your income.

Of course, capital gains and their associated tax needs to be managed. Keep in mind that unless you invest badly, this tax obligation will grow and will need to be paid eventually – if not by you, then by your beneficiaries. This harvesting of capital gains adds to your normal income flow in a ‘total return’ strategy.

As some general rules of thumb:

- capital gains are taxed at a lower rate than other types of income like interest payments or share dividends;

- gains from investing in your own name are taxed at half the rate of your income;

- for superannuation in the accumulation phase, gains are taxed at two-thirds the rate of income; and,

- super pensions are untaxed after age 60.

While international equities typically pay lower dividends than Australian equities (shares) – and they offer no franking credits – they may provide better potential for capital growth where buybacks are favoured to dividends, as funds are reinvested in the company for growth. This is especially prudent to keep in mind as markets adjust out of boom periods, such as the 2020 adjustment out of the mining boom.

Financial Strategies

Thirst for income is likely to continue when interest rates are expected to stay low, which in turn keeps government bond yields low for longer and their valuations unattractive.

Looking past bonds, the prices of high-dividend shares have historically been high and in 2020, dividends were cut or suspended.

The lesson? Striving too high for an income target tends to push your portfolio further out on the risk spectrum.

Whilst every wealth management firm or investments adviser can take a different approach, at Perks Private Wealth, we encourage a more holistic, total return approach to your sustainable spending needs from investments.

An improved portfolio includes a wide range of income sources providing both cash flow and capital growth. A sound guiding principle is that your chosen blend of investments should match your overall financial goals, consider your tolerance for risk, expected time frames, income and liquidity needs and with a spending rate that sustains the investor’s – your – wealth.

Whilst our ongoing care clients are familiar with all this, for those that might be need further counsel, it’s worth noting that aside from the usual strategic financial planning advice you would expect from a wealth management firm, we also provide ongoing advice about investment selection, including directly held ASX-listed securities and can even provide access to unlisted alternative asset classes, if these are appropriate for where you are in your wealth creation journey.

Conclusion

The important thing to remember that just like servicing and maintaining your car will improve its performance and lifespan, doing the same with your financial future via an Adviser that you know acts in your best interests first and foremost, will improve your sense of control, peace of mind and investment outcomes now and in the future.