Australian Government Coronavirus Stimulus Package Highlights

Posted on 16/3/2020

Accounting

Overview:

The omnipresent threat and resultant panic of coronavirus (or COVID-19) in Australia will inevitably lead to an economic impact on both small and large businesses. Whilst toilet paper and tinned food manufacturers ride the initial wave, the negative impacts arising from abandoned stadiums, work places and schools will have significant knock-on effects for businesses.On 12 March 2020, the Federal Government announced an economic stimulus package to assist in keeping the Australian economy ticking along during what could be months of uncertainty. What follows is a high-level explanation of the Government support on offer.

Looking for a ready-reckoner? Take a look at our summary table at the end of the article.

There are now updated versions of this article:

Looking for the latest on the proposed Government Stimulus Package for Businesses? Click Here

Looking for the latest on the proposed Government Stimulus Package for Individuals and Households? Click Here

Support for Business

There are several initiatives targeting businesses that are tried and true stimulus measures.

Instant Write-off on Plant & Equipment

Currently, the instant asset write-off threshold is $30,000 per asset and the eligible turnover threshold is $50M.

From the date of the announcement until 30 June 2020, businesses with an aggregated turnover of less than $500M can immediately write-off the cost of an asset where the cost of the asset is $150,000 or less.

The threshold applies on a per asset basis, so eligible businesses can immediately write-off more than one asset acquired during the remainder of the financial year (prior to 30 June 2020).

For businesses with a small business entity depreciation pool that has a pool balance of $150,000 or less at the end of the financial year, the entire pool balance may be written off (deducted).

Example:

Mr MacDonald runs a farm in the South East with a prior year turnover of $4M. Mr MacDonald’s business acquires a new header unit for $85,000. Under the current rules, as the asset’s cost exceeds $30,000, Mr MacDonald is required to deduct (depreciate) the new header unit over its effective life under either the diminishing value or straight-line method. Where Mr MacDonald acquires the new header unit between 12 March 2020 and 30 June 2020, Mr MacDonald may claim an instant deduction equal to 100% of the unit’s cost.

50% Write-off on Plant & Equipment

Businesses with an aggregated turnover of less than $500M will be able to write-off 50% of the cost of an eligible asset (once installed ready for use), with existing depreciation rules applying to the balance of the asset’s cost.

The initiative is limited to a 15-month period from the date of announcement through to 30 June 2021.

Given the instant asset write-off discussed above, this initiative will apply to assets with a cost exceeding $150,000 until 30 June 2020 and to assets over $30,000 in the 2021 financial year.

Example:

Assume Mr MacDonald also buys a truck & trailer for $200,000. Under the current rules, as the asset’s cost exceeds $30,000, Mr MacDonald is required to deduct (depreciate) the truck & trailer over its effective life under either the diminishing value or straight-line method. Where Mr MacDonald acquires the truck & trailer between 12 March 2020 and 30 June 2020, Mr MacDonald may claim an up-front 50% deduction ($100,000) as the truck & trailer’s cost exceeds $150,000. The remaining $100,000 in written down value is claimed under the normal depreciation rules.

Cash Flow for Employers

Businesses with employees and a prior year aggregated turnover of less than $50M will receive a tax-free payment of up to $25,000 (minimum payable of $2,000).

The payment will be arranged by the ATO via a credit in the activity statement system from 28 April 2020 upon businesses lodging upcoming activity statements. The amount of the payment will be determined as follows:

- Eligible businesses that withhold tax to the ATO on their employees’ salary and wages will receive a payment equal to 50% of the amount withheld, up to a maximum payment of $25,000.

- Eligible businesses that pay salary and wages will receive a minimum payment of $2,000, even if they are not required to withhold tax.

Example A:

Peter runs a hairdressing salon and employs 8 full time hairdressers who earn $89,730 per year. In the months of March, April and June for the 2019-20 income year, Peter reports withholding of $15,008 for his employees on each Business Activity Statement (BAS).

Peter will be eligible to receive payment on the lodgement of each BAS as follows:

-

- A payment of $22,512 for the March period, equal to 150% of his total withholding.

- A payment of $2,488 for the April period, before he reaches the $25,000 cap.

- No payment for the May period, as he has now reached the $25,000 cap.

- No payment for the June period, as he has now reached the $25,000 cap.

Example B:

Eddie runs a toupee shop and employs two part time toupee fitters who each earn $10,000 per year. In the March and June 2020 quarterly BAS, Eddie reports withholding of $0 for his employees as they are under the tax-free threshold.

Tim will be eligible to receive the payment on lodgement of his BAS. Eddie’s business will receive:

-

- A payment of $2,000 for the March quarter, as he pays salary and wages but is not required to withhold tax.

- No payment for the June quarter, as he has already received the minimum payment and he has no withholding obligation.

If Eddie begins withholding tax for the June quarter, he would need to withhold more than $4,000 before he receives any additional payment.

Apprentices and Trainees

Small businesses employing less than 20 full-time employees can apply for a wage subsidy equal to 50% of an apprentice’s or trainee’s wage paid for up to 9 months (from 1 January 2020 to 30 September 2020). The subsidy is limited to $21,000 per apprentice/trainee.

If a small business is not able to retain the apprentice, the subsidy will be available for any new employer that employs that apprentice.

Support for Individuals

In the shadows of former PM Kevin Rudd’s $950 payment to individuals earning less than $100,000, the Federal Government is offering more targeted cash payments as follows:

- $750 to those individuals receiving government benefits (social security, veteran and other income support recipients).

- Payments will be made from 31 March 2020, assumedly directly to declared bank accounts for social security purposes.

- The payments will not be treated as taxable income.

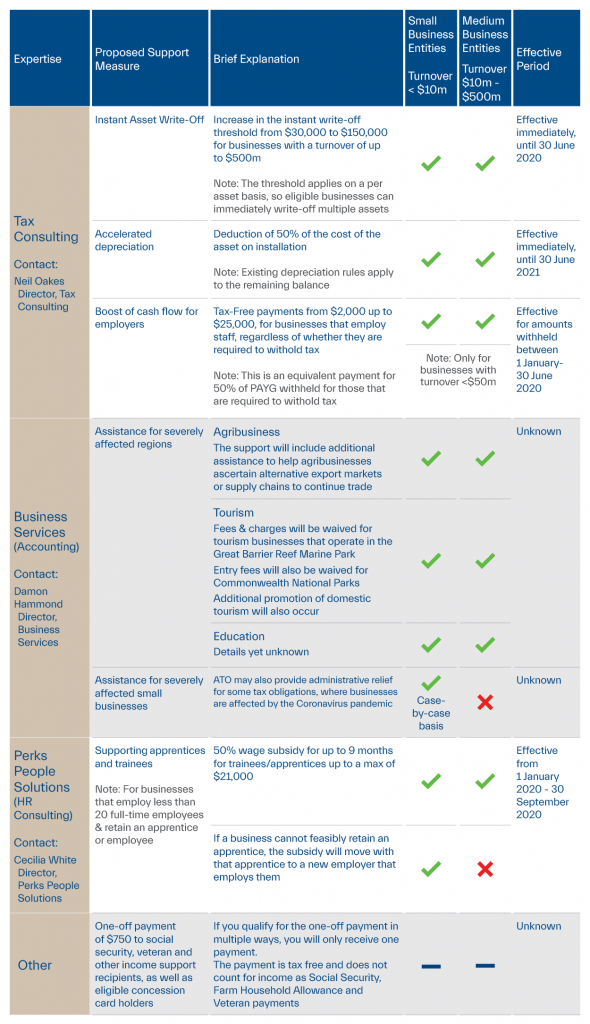

Summary Table

Related insights.

2025-26 Federal Budget Summary

26/3/2025

Tax

On 25 March 2025, Treasurer Jim Chalmers presented the Australian Federal Budget for 2025-26. Key areas of...

Read more.

Show Me The Perks Podcast | Land for Renewable Energy with Sam Richardson

24/2/2025

In this episode of Show Me The Perks, host Kim Bigg speaks with Sam Richardson, Director at...

Read more.

Show Me The Perks Podcast | Fat Farmers with Michael Williams

28/1/2025

In Episode 14 of Show Me The Perks, host Kim Bigg speaks with Michael Williams, General Manager...

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.