March Quarterly Market Recap

Posted on 21/4/2020

Private Wealth

Overview:

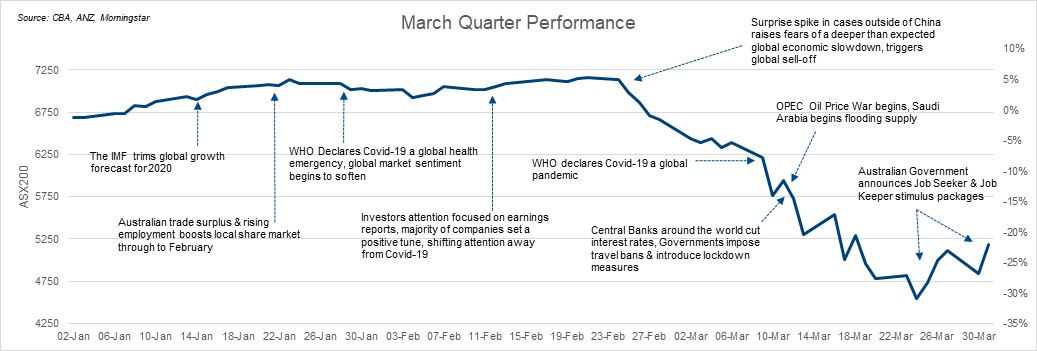

The World Health Organization declared COVID-19 a pandemic, triggering fears of a global slowdown and a potential recession – the perfect recipe for markets to experience some of their worst days in history, and equally, for Governments to deploy their biggest stimulus packages in history to support struggling economies.

Key highlights

- The quarter began with heightened tensions between the U.S. & Iran trading missile strikes, but just as quickly as they flared up, tensions retracted.

- In January, the World Health Organisation (WHO) declared Covid-19 an epidemic, later declaring this a global pandemic by early February.

- Britain officially departed the EU on January 31. Prime Minister Boris Johnson has until the end of the 2020 calendar year to lock in a deal with the EU to avoid a hard “no deal” exit.

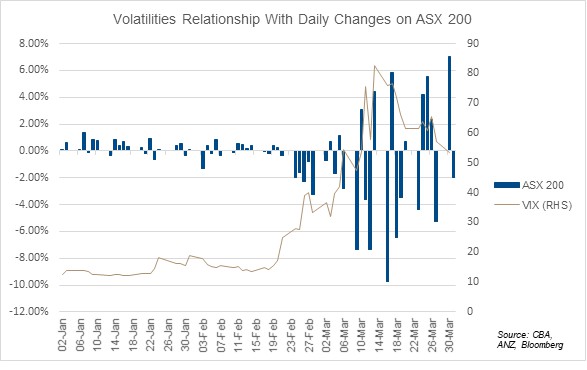

- The ASX suffered its worst loss in history, wiping 9.7% ($182bn) from the market in a single day, eclipsing the October 10 one-day fall in 2008 of 8.3% during the height of the GFC. As a reflection of the volatile markets, it also recorded its best day in history, rising 7% in a single day in response to the Morrison Government unveiling its third virus related stimulus package.

- The RBA cut the cash rate twice (by 25bps each time) during the month, reaching its nominal effective lower bound of 0.25%. The RBA gave forward guidence, noting “the Board will not increase the cash rate until progress is being made towards full employment and it is conifdent that inflation will be sustainably within the 2-3% target band”.

- The RBA began its Quantitative Easing (QE) program, announcing it will now be purchasing bonds in both Australian Commonwealth Government and Semi Government Bond Markets until further notice. The RBA outlined it will purchase these bonds across the yield curve, meaning, bonds of six-month maturity or longer (10+ years) on at least a weekly basis.

- The Federal Reserve also cut its cash rate twice, bringing its target rate range to 0% – 0.25% (down from 1.00% -1.25%). Chair Jerome Powell said he expects “the virus and the measures that are being taken to contain it will surely weigh on economic activity for some time”. In following, the 10-year U.S. treasury yield fell below 1% for the first time ever as nervous investors moved money out of equities and into safer assets.

- As a reflection of the ongoing market uncertainty, the volatility index (VIX) hit 85.47, its highest ever level since the GFC. By comparison, it reached 89.53 during the 2008 financial crisis only briefly, it has remained at this level for the majority of the month of March

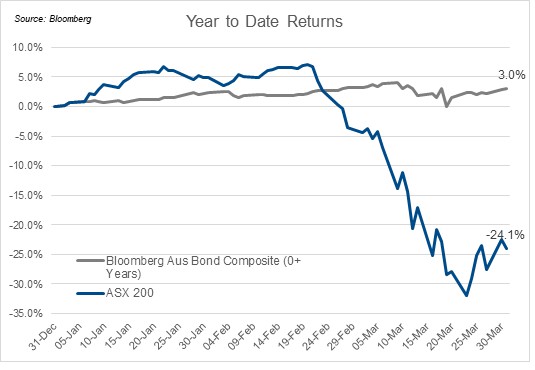

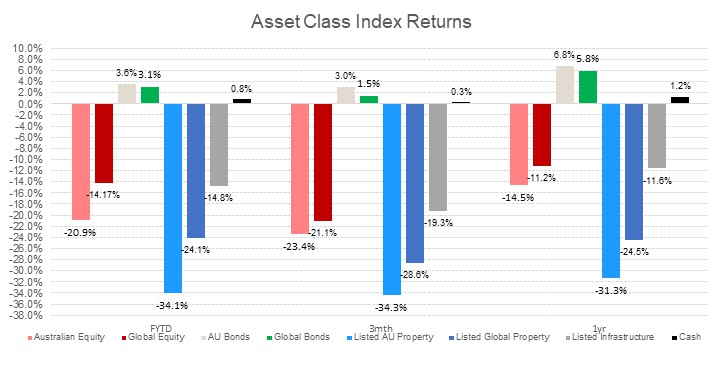

- Sector performance for the quarter: Australian Equities (-23.4%), US Equities (-20.0%), Global Equities (-14.2% Hedged, -1.2% Unhedged), Australian Fixed Income (3.00%), Global Fixed Income hedged (1.50%), AU Real Estate Investment Trusts (-34.3%). The Australian dollar hit an 18-year low, buying 57 U.S. cents.

Other points of interest

The Australian Government has unveiled a suite of economic support in response to Covid-19, currently totalling $320 billion, or 16.4% of GDP. The first part of the package took the form of a one-off cash payment of $750 to 6.5m lower income households totalling $4.8bn and $2,000 – $25,000 cash payments to 690,000 small-to-medium sized businesses. The balance of the stimulus suite are the ‘JobSeeker’ and ‘JobKeeper’ payments. At a high level, the JobSeeker payments are an additional payment $550 to those already receiving income support payments. The JobKeeper payments are a subsidy to businesses, aimed at keeping more Australians employed, with those eligible receiving a payment of $1,500 per fortnight from their employer on behalf of the Government. Both payment programs are scheduled to run for six months.

The U.S. Federal Reserve also announced its own QE program, setting an ‘infinity’ limit on the amount it will repurchase, up from the previously stated USD$700bn. The Fed will target Treasury bonds (both short and long dated), corporate bonds and mortgage backed securities in order to maintain market liquidity and quell volatility. President Donald Trump also unveiled a USD$2 trillion rescue stimulus package, following a similar tune to other Governments around the world, the package is designed to support businesses and provide financial aid to those households most affected by the Coronavirus outbreak.

For Commodities, the price of Oil (Brent Crude) fell (-65.5%) across the quarter after OPEC (The Organization of the Petroleum Exporting Countries) and Russia ended a 3-year production agreement. OPEC’s take-it-or-leave-it ultimatum of an output cut of 1.5mb/d (an attempt to support prices during slow global economic growth) was rejected by Russia. The current agreements expire at the end of March, from April 1, producers from the group can ‘open the taps’ and increase output with no restrictions. Iron ore enjoyed modest gains (+4.37%) for the month, showing short term resilience against the weakening economic outlook. The price was largely supported by the supply side, with Brazilian producer Vale announcing it was temporarily halting operations at its Malaysian port due to the Coronavirus outbreak. This situation may eventuate locally in Australia, but for now prices are finding some strength due to declining inventories in China. In the near-term prices are expected to decline in line with reduced global demand for finished steel.

For the Fixed Income sector, even in the low yield environment, has shown this quarter why it has a quintessential place in any diversified portfolio – especially if growth continues to trend downwards. Domestic Fixed Income returned a pleasing (+3.0%) return for the quarter, outperforming Domestic Equities by (+27%).

Related insights.

Perks Welcomes New Directors to its Group Board

8/1/2024

Original Article: September 2023

We welcome two new members to the Perks Group Board and look forward to them making a...

Read more.

Show Me the Perks Podcast | From Nest to Nest Egg: A guide to the First Home Super Saver Scheme

28/11/2023

In this third instalment of Show Me The Perks, our host Kim Bigg chats to Sam Wagner,...

Read more.

Show Me the Perks Podcast | The $3 Million Super Tax: Will it affect me?

10/11/2023

In the latest episode of Show Me The Perks, Kim Bigg, sits down with the Simon Wotherspoon,...

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.