A New JobKeeper on the Horizon…for Some

Posted on 2/9/2020

Updated 25 September 2020 - Hospitality

Overview:

The extended JobKeeper scheme imposes changes to eligibility the hotel industry should be aware of. Find out how the changes affect your business. As published in the September edition of the Australian Hotel Association SA's Hotel SA magazine.

Many Publicans are facing uncertain times with the imminent end of the first wave of JobKeeper and a lack of clarity around the recently announced second wave of JobKeeper on the horizon.

Fuelling changes to the current JobKeeper scheme was a Treasury review which found that of the 3.5 million workers accessing JobKeeper, around 900,000 were actually better off under the scheme by an average of $550 per fortnight. Further fanning the flames of needed reform were widespread reports of casual, part-time and stood-down employees that were either refusing or reluctant to perform additional hours of work when affected businesses started to re-open operations.

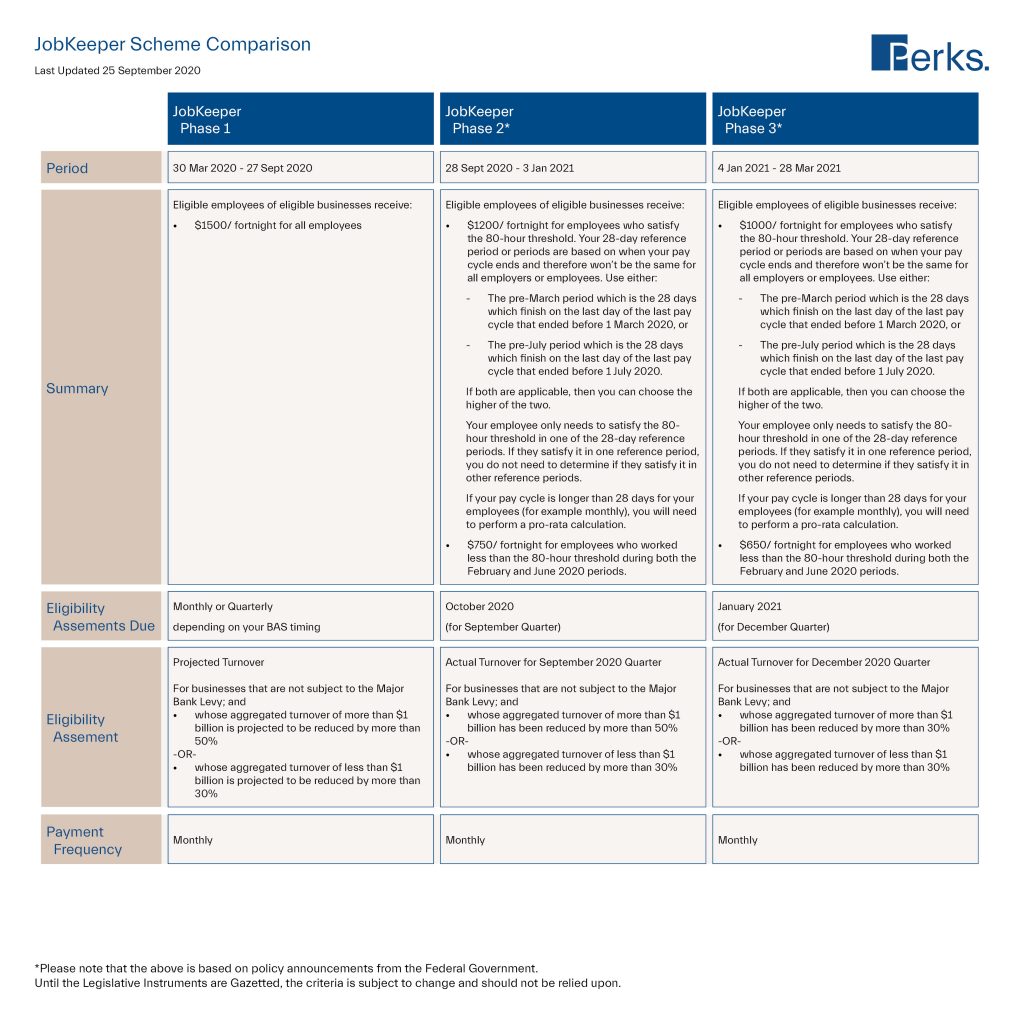

So although JobKeeper has been extended, moving forward, there are a number of changes to the scheme. Among the key changes for those in Hospitality are:

- business eligibility based on actual, not projected, reduction in turnover;

- employees employed as of 1 July 2020 (previously 1 March 2020) will be eligible; and

- a two-tiered payment system based on the number of hours worked by employees prior to COVID-19.

At the time of writing this article, the ATO has not provided clarity on the next phase of JobKeeper post 28 September as formal rules are yet to be formalised by Treasury. The Federal Government’s JobKeeper extension announcement on 21 July 2020 has already been qualified and amended by further announcements on 7 August 2020.

Below is a summary comparing what we do know about the new regime to the current regime, to help you navigate the information presently available. Click here for a printable version.

Due to the fast-changing nature of the coronavirus outbreak in Victoria, further clarifications and amendments are expected. All

information provided in this article should therefore be taken with caution. Make sure to seek the advice of your accounting partner / business adviser before taking any actions or reach out to one of us (Pat or Tom) if you need help.

Stay Ahead of the Game

At the time of writing, the ATO is yet to release full details of the amended JobKeeper scheme, but it is never too soon to consider how “best and worst case” scenarios will impact your operation.

Here are a few points to consider:

- recent Award changes (and flow-on effects to your Payroll)

- impacts of no longer being eligible for JobKeeper

- timing / impact of any bank deferments that are tied to JobKeeper.

If you haven’t already had a robust discussion with your bookkeeper and tax adviser, book in to see them. It can’t be underestimated how important having a strong handle on the economic levers of your business will help you prepare for the months ahead.

Related insights.

Show Me The Perks Podcast | Demystifying R&D: How SMEs Can Benefit from Tax Incentives

3/12/2024

In this episode of Show Me the Perks, we welcome Mark Reuter, Senior R&D and Indirect Tax...

Read more.

Unwrap Tax Savings: A Christmas Handbook for Business Owners

30/11/2024

With Christmas fast approaching, rewarding team members for their efforts throughout the year may be on the...

Read more.

Show Me The Perks Podcast | Powering Through: Ben Knispel on Tackling Rising Business Costs

28/10/2024

In this episode of Show Me the Perks, host Kim Bigg welcomes Perks Client, Ben Knispel, joint...

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.