The COVID-19 Impact on Markets

Posted on 13/7/2020

Investment Research

Overview:

Head of Investment Research, Jason Russo analyses the impact of COVID-19 on the local and global investment market in this in-depth report.

The global economy fell a significantly with the on-set of the COVID-19 pandemic, but the impact of policy easing cannot be overestimated. Swift action by central banks has eased many of the tensions in financial markets that built in February and March. Credit markets have reopened. Capital outflows have steadied across emerging market debt and equity funds. In addition, as with other countries globally, policy measures adopted so far appear to have worked well in terms of cushioning the impact on the economy and reducing negative returns.

However, the second stage of this economic recovery will require a sustainable medical solution, such as a vaccine or effective COVID-19 treatment, and a return to pre-pandemic levels will not be seen until well into 2021 or beyond. While certain sectors have done well during the pandemic (technology, digital media, e-commerce), some important sectors are still far from being back to normal. This gap implies unemployment rates are likely to stay high, and the threat of bankruptcy persists for companies in these struggling sectors including retail, hospitality, travel and energy. The increasing US/China trade tensions is also a threat. Global central banks have little ammunition left, except keeping policy rates at zero and government bond yields extremely low. Governments will need to continue to support low-income families and businesses (Jobkeeper, tax concessions) coupled with increased Government spending on things like infrastructure. Through Government spending, those countries with low government debt, such as Australia, could starve-off a prolonged recession as the economy continues to live on life-support.

What’s keeping investors up at night?

- Unsustainable Government bond purchasing programs

- Overvaluation of the market

- US/ China tensions

Unsustainable Government bond purchasing programs

Most developed economy central banks have opted for zero policy rates, engaging in increased asset purchasing to maintain market liquidity and keep yields low. With this first stage of recovery, we may see central banks reduce their scale of asset purchases in order to ease the economy back to sustainable level. However, we are unlikely to see a complete pull-back of this policy until a second stage of recovery is apparent.

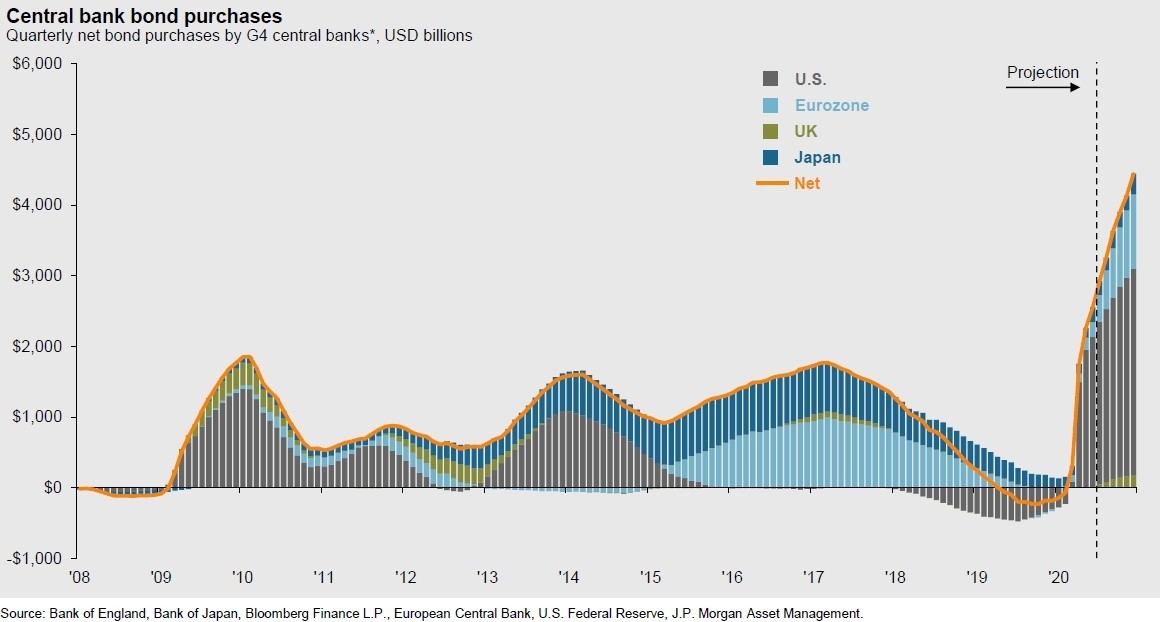

The chart below shows the 12-month rolling flow of bond purchases by G4 central banks. We can see the scale of asset purchases, especially by the Federal Reserve (Fed) and the European Central Bank (ECB), has been very aggressive even compared to the global financial crisis in 2008-2009.

The pace of asset purchases is likely to slow with improving economic data. However, it will take a considerable amount of time, and material improvements in economic conditions, for central banks to consider shrinking their balance sheets, especially given the surge in government debt.

Overvaluation of the market

Low yields have already pushed investors to take on additional credit risk or liquidity risk to generate income. This trend is likely to continue as low yields continue. Markets are almost overlooking the risk of a second wave of infections in the U.S. and Europe as well as the escalation of U.S.-China tensions in the months ahead. Markets are also possibly overestimating an early sustained solution to the COVID-19 pandemic.

The recent positive economic data and the very accommodating monetary policies by central banks has led to the rebound in asset prices at a speed not seen in history. The pace at which U.S. equities have recovered from losses is unparalleled to prior bear markets, which has been reflected in rising valuations.

Bear market: A bear market is when a market experiences prolonged price declines.

The graph below shows the S&P500 price return close to its peak 19 Feb 2020 which took less than 100 days. In comparison, the market crash of ‘87’ took more than 400 days to recover and the GFC (2007) more than 1400 days.

The rally in global equity markets after the sell-off in March has been startling. Investor confidence has lifted following support from policymakers and central banks, while the earlier-than-expected reopening of some economies raised hopes of a very short recession in many countries.

There is a risk that markets are priced for the very best outcome when there are still risks of a potential second wave of COVID-19 infections or the geopolitical strains that investors have so far largely overlooked.

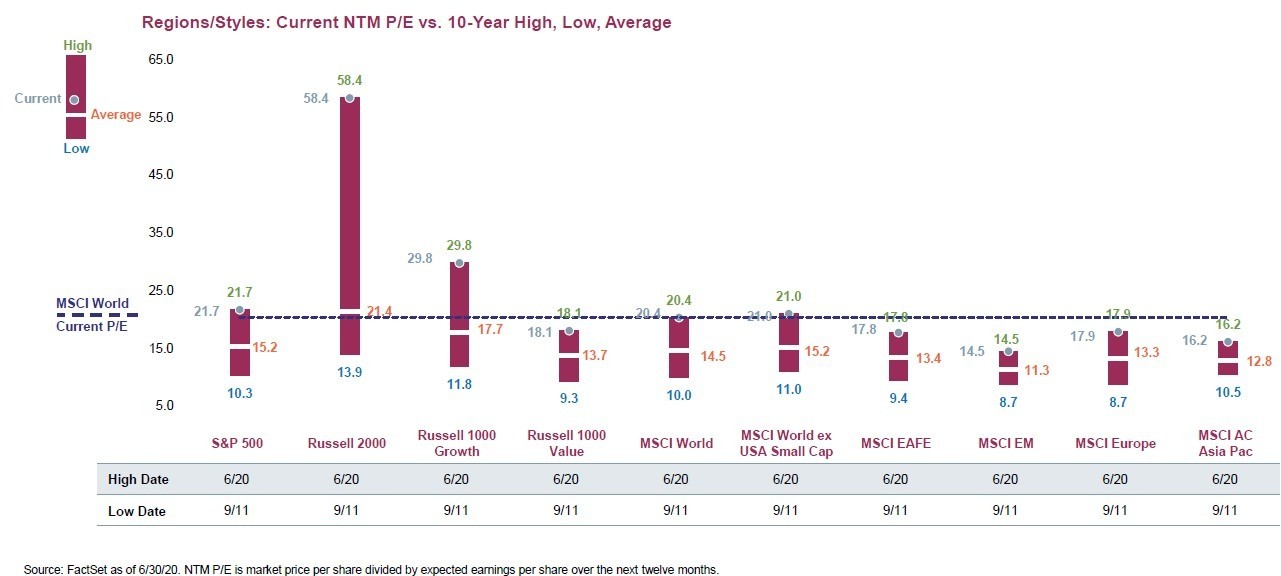

The graph below shows the Price-to-earnings ratio (P/E) 10 year range for the major markets around the world with current P/E’s shown by the blue dot, the average represented by the orange numbers and the high in green and the low in blue font. All of the below market indices are at the top of their 10-year range limits emphasising an overheated market.

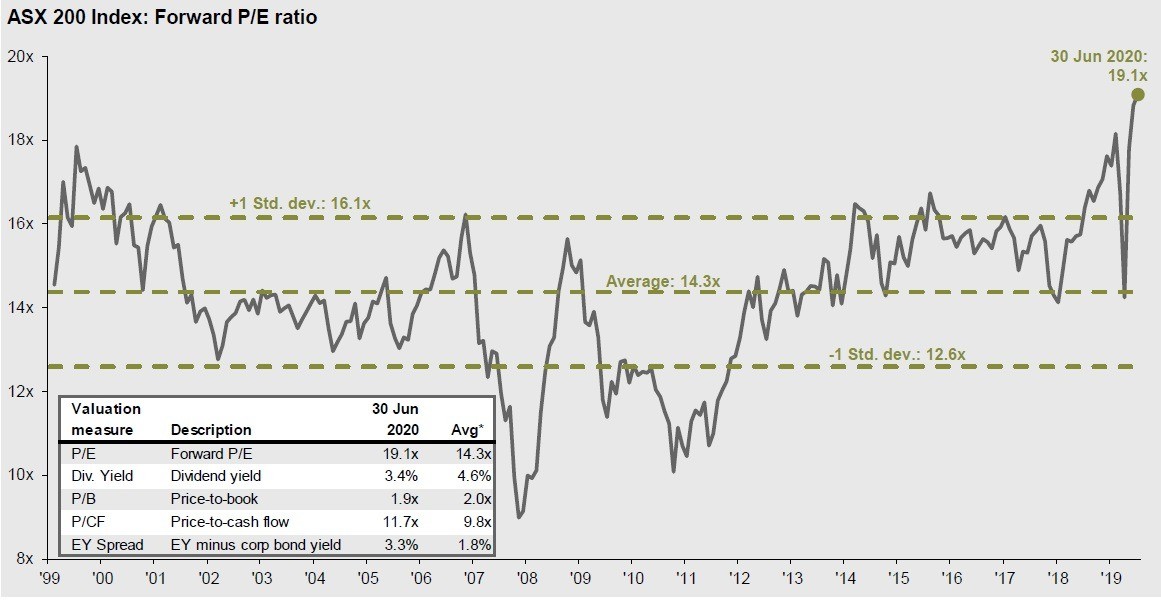

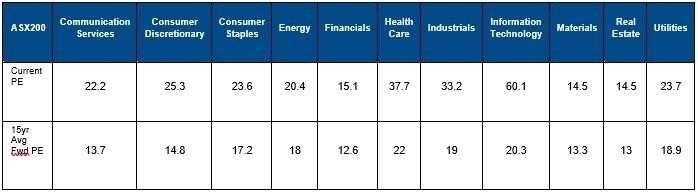

Australia has not escaped this paradigm, with its current P/E ratio reaching its highest level in the last 20 years at 19.1x, compared to the 20-year average of 14.3x (as shown below). When we break this down by sector (Table 1), the story is the same.

Source: FactSet, Standard & poor’s, J.P. Morgan Asset Management. Price-to-earnings is price divided by consensus analyst estimates of earnings per share for the next 12 months. Dividend yield is calculated as the next 12 months consensus dividend divided by most recent price. Price-to-book ratio is the price divided by book.

Table 1

Equity investors are looking beyond the severe earnings recession in 2020 in anticipation of a robust recovery in 2021 as communicated by company CFO’s and stock analysts. However, we expect uneven performance across sectors given a gradual recovery. Much of the rise in markets has been concentrated on those companies that are perceived to have been beneficiaries of the shutdown. Basically, global equity markets, which have now bounced back to be close to flat for 2020, are being led by the winners in this new environment, such as companies in the information technology sector and e-commerce. Technology, telecommunications and health care have led this defensive rally. For the worst-hit sectors, such as airlines, travel and energy, any sort of recovery will require a quick medical solution or a vaccine for these industries to regain anything close to their pre-pandemic levels.

US/China tensions

As policymakers and businesses are struggling with the impact of COVID-19, rising tensions between the US and China could exacerbate the damage already done to supply chains from the coronavirus pandemic. Regardless of the result of the presidential election in November, the relationship between China and the U.S. is likely to remain challenging. U.S. President Donald Trump has threatened to reintroduce tariffs on Chinese exports. Any rise in trade tensions between the US and China would put additional strain on a global supply chain that has already been damaged by the coronavirus pandemic.

The need to diversify supply chain risks and being could see businesses diversify their investments across Asia and other emerging markets.

In summary:

- The COVID-19 pandemic intensified many of the material themes that were already present in the global economy and brought an end to the longest economic expansion since the Second World War.

- Risk assets around the globe have staged a robust rebound since the March lows as aggressive fiscal and monetary policy by central banks have driven positive market sentiment, however, economic activity will continue to be below pre-pandemic levels. Investors will need to distinguish the real growth rate when compared to the level of economic activity.

- Yields are likely to stay low and the pursuit for income will intensify. With the global economy stabilising, investors should search for yield across equities, fixed income and alternative assets.

- US/ China trade tensions, a prolonged search for a sustainable medical solution for COVID-19, a delay in earnings recovery and a potential second wave of infections and its impact on the global economy are risk factors that investors should be prepared for. Investors should seek a diversified balanced portfolio, with emphasis on income generation.

- However, stock and bond markets plunged in tandem during the peak of the pandemic as investors made a dash for cash – highlighting a correlation trend that is eroding the diversification benefits of traditional multi-asset portfolios. To gain diversification benefits, investors might consider non-traditional asset classes.

Related insights.

2025-26 Federal Budget Summary

26/3/2025

Tax

On 25 March 2025, Treasurer Jim Chalmers presented the Australian Federal Budget for 2025-26. Key areas of...

Read more.

Perks Welcomes New Directors to its Group Board

8/1/2024

Original Article: September 2023

We welcome two new members to the Perks Group Board and look forward to them making a...

Read more.

Show Me the Perks Podcast | From Nest to Nest Egg: A guide to the First Home Super Saver Scheme

28/11/2023

In this third instalment of Show Me The Perks, our host Kim Bigg chats to Sam Wagner,...

Read more.

Want to receive our insights?

Sign up to receive important financial updates, useful tips, industry trends and whitepapers.